Articles

Adrian Snead, a partner from the Porter Wright Morris & Arthur who assisted to enter a national financial expenses in the 2015, told you within the a contact the newest CBO deposits imagine is actually “lifeless incorrect” and you will underestimates the positive worth of Secure. By the bolstering courtroom confidence to own organizations, the new CBO said they anticipates S. 2860, if the wolfrun casinos introduced within the 2024, to improve covered lender dumps by the on the $1.5 billion in the 2026, ascending to $dos.9 billion by the 2034. Credit union places create develop because of the $125 million inside 2026 and you can $475 million from the 2034. Laws to loosen up marijuana financial laws do increase covered banking dumps because of the more than $3 billion by the 2034, depending on the Congressional Finances Workplace.

Wolfrun casinos – Functions

- Having high prices and freedom to choose how frequently you receive focus money, Macquarie Identity Deposits are providing Australians rescue more.

- The fresh device series right up for every transaction and you will moves the excess transform so you can a savings account.

- The following one-fourth internet costs-of rates to possess playing cards is the highest speed claimed while the third quarter 2011.

For many who put your money in a savings account, the financial institution will pay your a small amount which is sometimes called focus. Click the, buttons less than for more information on every one of these topics. If you’d like to withdraw financing before maturity, you need to give us at least 29 time’s see and a break percentage could possibly get pertain.

Why is also’t I have found a lender campaign as opposed to head deposit standards?

The fresh Canadian Mental health Relationship (CMHA) account you to definitely males make up 75 percent away from suicides within the Canada, a statistic Movember is designed to changes by the creating mental health and you may guaranteeing people to speak openly regarding their fight. And Area Loved ones and Area Support Services (FCSS) hosted children violence reduction experience to the November 5 in the Days Inn Norsemen. At this knowledge, more 75 attendees got to read about the effects from members of the family assault, handling sadness and you will damaging the period of dangerous socialization one to prompts most people to do something to your bad emotions. Participants, also known as “Mo Bros”, expand a great mustache on the month in order to spark discussions from the people’s fitness.

Custodial and you may cleaning functions used by Atomic Broker can be obtained to the its BrokerCheck declaration. Influence on your borrowing from the bank can differ, while the credit ratings try on their own determined by credit bureaus according to plenty of points including the monetary decisions you make that have other economic services groups. Financial institutions that offer a bank account incentive so you can the fresh members tend to be Lender from America, BMO, Money You to, Pursue, KeyBank, PNC Financial, SoFi Bank, Letter.A great., TD Financial, You.S. Lender and you can Wells Fargo. See these pages per month to find the best savings account promotions readily available. Which render is all of our finest see to possess an indication-upwards incentive to own a mixed checking and you will bank account. Did you know that banking institutions pay you to definitely maintain your currency within accounts?

Using this type of research, we emphasized more recognized features and most popular issues for for each lender. I rated for each and every bank in just about any metric and making use of the newest factor weightings determined our final checklist. The ranking of the greatest higher-produce deals accounts comprises of the new eight banks, credit unions and you can fintech firms that had been greatest scorers. I opened accounts with each to take you initially-hand profile of your techniques. Even though many financial institutions provide 4% to 5% APYs (or higher) to the high-give deals accounts, our latest consumer financial questionnaire suggests 62% away from People in the us secure less than 3% inside attention on the offers or money business account. Next chart shows the new dollar improvement in financing balance to your a good quarterly and you may annual foundation.

Requiring at least level of advice, it account is actually perhaps one of the most smooth to open up. As well as, you may make your own offers requirements close to your property display screen and you will take part in automated rounding from your family savings so you can deposit your free change into deals. Additional rates affect other investment number, conditions and you may desire frequencies. Very early withdrawal fees will apply as well as the account usually sustain an interest loss of respect away from the bucks withdrawn or transmitted early. At the readiness we are going to reinvest your ANZ Progress Observe Label Deposit in line with the reinvestment agree you may have given all of us as well as in accordance having recommendations you have offered.

Caulfield chatted about the fresh stunning bequeath from misinformation and its own fatal outcomes. The guy mutual preferred myths, damages of assuming inside incorrect suggestions more scientific items, and you will found how many influencers are utilising the systems in order to bequeath so it poison in our people. Happily, experts also are finding that hereditary tendencies will likely be changed or reversed.

The First-Hands Sense Starting UFB Lead High-Produce Checking account

The newest EPR system goals single-have fun with products and packaging used by home-based homes. The metropolis’s wedding inside system you’ll render confident transform so you can local recycling cleanup, having will set you back financed by the suppliers instead of taxpayers. “I would become more than simply ready to answer any queries somebody have in the my personal most recent exhibition titled Retrospect.

Within the figuring if your deduction are $500 or maybe more, combine the claimed write-offs for everyone comparable pieces of assets donated to your qualified business in the seasons. You might claim a good deduction for a contribution of $250 or even more only when you have an excellent contemporaneous composed acknowledgment of one’s share from the certified business or specific payroll deduction details. Discover Contemporaneous written bill (CWA) after, to own a reason away from whenever a written acknowledgement is recognized as “contemporaneous” with your sum. Efforts on the second category of qualified groups otherwise “for the usage of” people certified business. Enter online 11 of your own worksheet 15% of your net gain for the 12 months out of the sole proprietorships, S businesses, or partnerships (or other entity this is not a c corporation) where efforts of dining directory have been made.

April step one, 2025 Camrose Enhancer

The deduction is actually limited to $15,100000 (30% away from $fifty,000), and also you carried over $twelve,000. This season, their AGI is actually $sixty,100000 and you contribute financing gain property valued in the $25,000 in order to a fifty% restriction organization. Their basis from the home is $twenty four,000 and you also go for the newest 50% restriction. You should refigure the carryover as you had removed enjoy into consideration just last year as well as this season.

Think gaming limits before playing a slot video game you to will pay genuine currency. Gambling limitations are different notably out of slot so you can slot, ranging from $0.01 in order to $500 for each twist, making sure truth be told there’s a game for everybody. The newest get back-to-athlete percentage (RTP) of a slot mode the fresh part of overall money starred one to is at some point paid in earnings.

To figure the amount of your own charity share, deduct the worth of the advantage you will get ($25) out of your overall percentage ($65). The fresh contributions must be designed to a qualified business and not arranged for usage by a particular people. The ensuing list provides some examples away from licensed groups. Generally, only the following the type of communities might be certified groups. 590-B, Certified charity shipment one to-time election, to find out more.

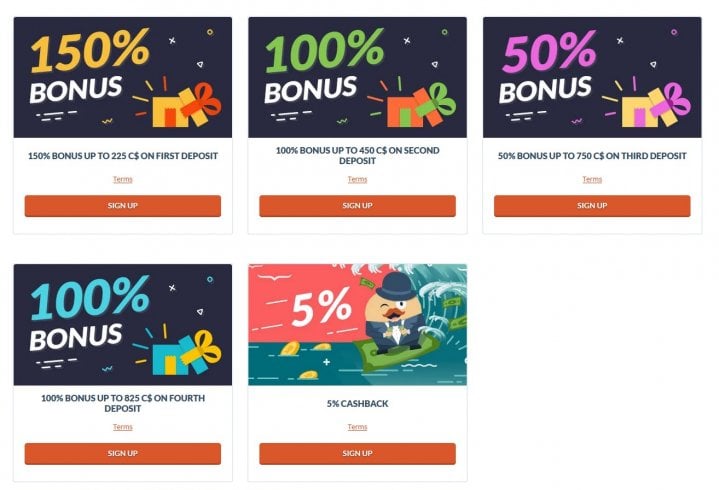

Which added bonus is even open to current Rare metal Deals accountholders you to sign up and you may complete the requirements. Available all over the country, CIT has to offer to a great $3 hundred invited extra once you discover another Rare metal Family savings and you may put the new currency. The quantity you can make hinges on simply how much your give the brand new desk — and it’s really perhaps not a small amount. You want at the very least $twenty-five,000 to earn a great $225 incentive or $50,100000 for the full $3 hundred. Rating a $300 incentive to possess acquiring direct places out of $5,one hundred thousand or maybe more.

Discover up to the lack of actual twigs when you are however reaping the key benefits of on the internet banking, let’s view numerous on the internet financial institutions and you may borrowing unions that enable you to definitely deposit dollars into your membership during the metropolitan areas such as ATMs and you will stores. Having fun with an online-only bank can indicate your’ll secure highest prices and you will shell out less charge than simply you would that have a brick-and-mortar financial. Although not, a potential downside of failing to have access to bank branches is that it’s harder in order to put cash in the membership. It’s the intermediate-measurements of banking companies one secure the very reciprocal dumps. These types of financial institutions is actually adequate to own consumers which have high deposits but nevertheless quick adequate that they might possibly be allowed to fail. There is certainly an obvious increase in the speed from development of these types of dumps performing immediately after 2018, a posture that is almost certainly a result of the newest legal alter discussed above.