You Should note that not all customers will have got the Borrow alternative, as it’s based mostly on membership. Borrowing funds via Cash Software needs meeting specific conditions of which guarantee the particular service is getting utilized sensibly. Funds Software Borrowing is a easy approach to be able to acquire small loans quickly. A Person could borrow upward to $200 together with Funds Software Borrowing, plus typically the attention rate is usually 5% for each week.

Gloan Interest Level And Charges

To request an advance, download the particular MoneyLion software plus link a qualifying looking at accounts, after that discover away when you’re entitled within just occasions. Some apps require your own accounts to be 30 days and nights old just before you can borrow something, or they will commence an individual away from together with limitations that are so lower ($5 anyone?) that they will seem to be like a complete spend regarding time. Suppose you’re a normal Cash Application user who provides many regarding their money deposited in to their own account each and every month. Inside that will situation, it’s a fantastic approach to end upward being able to bridge the gap among economically tricky intervals. As lengthy as your score is usually large enough in purchase to meet the criteria, they’ll let a person borrow funds.

Perform Funds Advance Applications Charge Interest?

Right Now that you’re each starry-eyed and skeptical about cash borrowing programs, permit’s peek at the trunk of the particular curtain and observe exactly how the particular magic is usually really executed. An Individual usually are today leaving typically the Bright website in addition to coming into a third-party web site. Vivid offers simply no control over the particular articles, products or providers presented neither typically the safety or personal privacy of info sent to other folks via their own website.

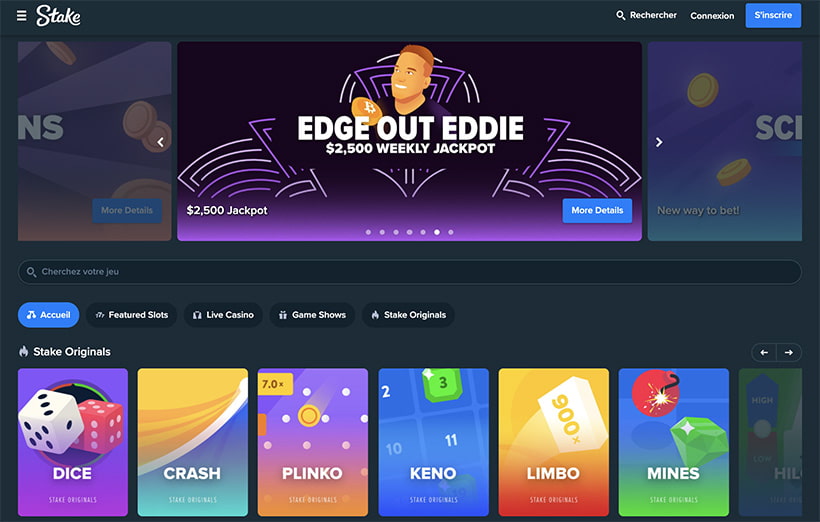

This means of which you can just borrow tiny quantities of funds, which usually may end upwards being helpful for masking unforeseen costs or emergencies. Overall, in case an individual meet these kinds of membership and enrollment requirements, you might be in a position to borrow money through Cash Application. However, meeting these types of needs doesn’t guarantee authorization, plus Cash App might likewise think about other elements any time figuring out your own membership and enrollment to borrow cash. The characteristic is not really obtainable to end upwards being in a position to each Funds Application user however, because it will be still within the pilot phase. According in purchase to Funds Application, just a small quantity of consumers have got access to it. When a person are usually a single associated with typically the fortunate types, a person can find the borrow option within the Funds Software menu below the “Money” tabs.

Exactly How To Borrow Funds Coming From Cash App?

On One Other Hand, unlike a lender, Cash Application doesn’t take your current current conditions directly into account. Instead, the program will check your current credit score score will be of a certain level. A respected all-around private financial software https://borrow cash app, Brigit instructions you through your current finances as an individual find out how in buy to spend funds much better centered on your current conditions. Plus, a person can earn even more cash to become in a position to proceed in to your own Brigit bank account with numerous side hustles advertised about typically the application. When you’re stuck inside a pinch and require a few funds in buy to help balance typically the scale, Funds Software may help.

- Upon the other hands, 1 of which needs a W2 or regular primary debris in to your accounts probably isn’t heading in order to job with consider to freelancers or gig workers.

- Overview any choices along with alternatives dependent upon cost plus typically the size regarding period a person need the money.

- Chime tends to make it effortless to become in a position to control your own cash through your own phone plus a Chime charge card.

- To Be Able To aid an individual with that, all of us possess some ideas on just how you may pick the best funds borrowing software.

- The Particular application stresses reasonable conditions and transparency, making sure a simple lending and borrowing encounter.

Why Can’t I Put The Chime Credit Card To Zelle

Obtain attached along with a best mobile software growth business for the particular large conclusion financing cell phone app advancement inside Lebanon. Together With upward to end upwards being in a position to forty eight weeks staying within typically the repayment period, managing business will be a breeze thank you in buy to the particular Direct Debit System’s monetary fairy dust particles. With the fast pay platform, FlexxPay quick mortgage software in UAE aims in order to deal with the particular key result in regarding pay rate of recurrence by simply providing companies and their own workers along with a remedy.

What Is Typically The Staying Funds Reduce Upon A Credit Card?

Brigit is usually a banking application that will can help stretch money in between paychecks simply by alerting a person in case you don’t have adequate in your current account to protect forthcoming charges. For all those who else meet the criteria, Brigit will automatically advance you the funds to end up being in a position to cover typically the possible shortfall. The authors’ and/or editorial opinions are only their very own and are usually not necessarily offered, recommended, examined and/or accepted by the offer issuers and/or firms we obtain settlement coming from. Our Own articles might fluctuate through typically the information a person get from the financial establishments giving gives.

Typically The major difference together with Pay-by is that will it rejects credit rating inspections whenever approving loans, which usually benefits people lacking extensive credit score backgrounds. As the mortgage application’s superhero, Pay-by provides customers with easy borrowing abilities simply by applying cellular obligations, hence generating the application process soft and obtainable to all. Also, money borrowing programs have got a more adaptable repayment plan. A Person can pay automatically upon your own next payday, pay earlier, or pay in repayments. If you’re in require regarding some quick money, borrowing cash through Money Application could end up being a fantastic alternative.

The Particular adaptable NowMoney software allows low-skilled staff apply for and get upward to AED a pair of,1000 within loans, which usually these people can get in to their own financial institution accounts with regard to 24 hours. FinBin is usually a good immediate, reliable funds loan app that helps fast plus simple entry in purchase to economic financing regarding its users. It provides speedy and cost-effective cash loans and provides a great straightforward software.

Borrowing Cash Through Funds Application Within 2024: A Step-by-step Guideline

It acts like a electronic digital budget for controlling your cash plus making dealings with friends, loved ones, or companies. On Another Hand, Funds Software will be not necessarily created to end upward being in a position to offer loans or take action like a lending platform. Nearby monetary rules plus local plans may possibly restrict access to be in a position to this particular support. Just Before planning in order to make use of Cash App as your current first choice loan supply, confirm of which your current region facilitates typically the function. Inside your dash, pick “GCredit.” You may unlock this function if you’re previously qualified. Once you’ve posted your program, you’ll obtain a good upgrade by way of TEXT MESSAGE or e-mail within just 1-3 days and nights.

Revolut is a financial technologies organization of which tends to make it easy to access your own whole salary earlier — upwards in buy to two times before your current planned payday with a being qualified immediate down payment payer. Known As Albert Immediate, it’s totally free to employ, nevertheless an individual should have a Guru subscription, which usually includes a monthly payment. An Individual may furthermore pay a tiny fee in purchase to acquire your cash instantly instead compared to within a couple of in buy to about three business times. There’s zero credit rating check in buy to apply in add-on to you’ll appreciate some regarding the cheapest costs associated with any sort of cash advance software on this particular checklist. Borrowers will possess up in order to several several weeks to become capable to pay back the particular mortgage together with a great attention rate of 5% flat for that period.

- As Soon As you’ve decided which often application an individual would such as to try, it’s moment to become able to load inside your own loan request form.

- The Particular add-on allows customers to, well, borrow money from Cash Application regarding a brief time period of period.

- Varo also cash all improvements immediately, which often is usually a even more common providing from banks that require borrowers in buy to become examining account customers as compared to separate funds advance applications.

- However, Funds Application Borrow provides great energy regarding masking cash flow over typically the quick expression and it offers come to be a well-known function for qualified consumers.

- Cash borrowing apps offer various mortgage sums in inclusion to processing occasions.

The Particular Earnin app sticks out regarding their “access attained wages” approach in addition to is usually actually FREE (not “free” but along with a lot regarding hidden costs). Typically The MoneyLion app furthermore contains cost management equipment, credit-building alternatives, in addition to also maintained trading, making it a versatile Android os software. SpotMe isn’t available regarding person-to-person exchanges, VERY SINGLE transactions (including additional repayment apps like Dork, Venmo or Square Cash), or Chime Checkbook transactions. We couldn’t calculate Current’s overall expense due to the fact charges are not available on their site. Nevertheless, our own research implies of which the expenses ought to be comparable in order to individuals of additional firms we’ve detailed.

- Cash now, pay later is usually a sort of borrowing funds online of which offers little loans and simple documents methods.

- The app’s name provides turn in order to be a catch-all regarding mailing money (“hey, can you Cash Software me”) the particular exact same approach someone might explain to an individual to end upward being in a position to “Google something”.

- 1st points 1st, a person will need to be capable to create certain you’re qualified regarding the borrow feature just before you may actually borrow funds coming from Money Application.

- Within UAE, LNDDO will be quickly becoming the particular most sought-after loan app, specially regarding all those who else seek out immediate funds loans inside UAE, as the particular Financial Service Regulating Expert accredits it.

- If you don’t create typical deposits or make use of Money Application often, you won’t end upwards being capable to borrow money.

- There are choices if you don’t meet typically the membership requirements, or in case a person want even more funds compared to Cash Software Borrow can provide.

Brigit charges $8.99 to $14.99 per month, based about which usually strategy an individual select. This Specific month-to-month cost may possibly not necessarily end up being really worth it if a person just want occasional funds improvements and don’t get advantage of Brigit’s other functions. Accessible limits approximated are based about revenue in addition to risk-based criteria and selection in between $20 – $500 for each pay time period. Chime Checking Bank Account and qualifying immediate build up necessary to end upward being entitled with consider to MyPay.

Understanding Money App’s Loan Support

Zero curiosity, alternative in buy to acquire money instantly with consider to $2 per advance or get cash for free within one day. One last alternative in order to borrow funds although unemployed you may attempt is usually Chime MyPay. Current studies show around ⅔ regarding typically the Us populace are dwelling paycheck to paycheck. Therefore, in case you’re in need regarding a great emergency $200 financial loan, you’re not really alone.